Disclosures

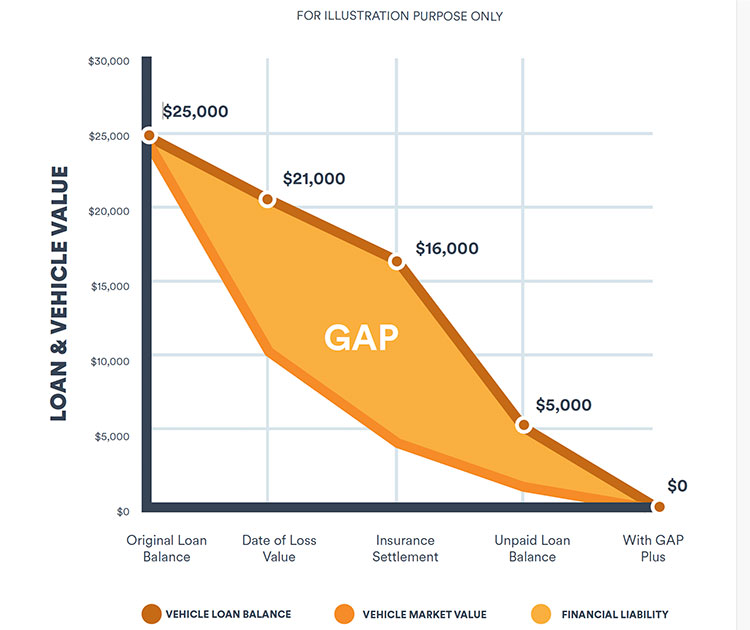

GAP, which includes deductible assistance, is not insurance; it is an optional debt cancellation product. GAP will not affect your application for credit or the terms of any credit agreement you have with us. Certain eligibility requirements, conditions and exclusions may apply. You will receive the contract before you are required to pay for GAP. You should carefully read the contract for a full explanation of the terms. If you choose GAP, adding the GAP Fee to the amount financed under your contract will increase the cost of GAP. You may cancel GAP at any time. If you cancel GAP within 90 days you will receive a full refund of any fee paid. GAP purchased from state-chartered credit unions in FL, GA, IA, IN, UT, VT, and WI may be with or without a refund provision. Prices of the refundable and non-refundable products are likely to differ. If you purchase a refundable product, you may cancel at any time during the loan and receive a refund of the unearned fee. GAP purchased from state-chartered credit unions in CO, MO or SC may be canceled at any time during the loan and receive a refund of the unearned fee. Auto Deductible Reimbursement Coverage will be provided to members under a blanket policy issued to participating credit unions. The Auto Deductible Reimbursement Coverage is underwritten by Arch Specialty Insurance Company.

GAP is not insured by NCUA or any Federal Government Agency; is not a deposit of or guaranteed by the Credit Union or any Credit Union Affiliate; and may prove to be an investment risk.

Mechanical Repair Coverage is provided and administered by Consumer Program Administrators, Inc. in all states except CA; where coverage is offered as insurance by Virginia Surety Company, Inc., in NH; where coverage is provided and administered by Consumer Program Administrators, Inc. dba Consumer Warranty Program Administrators, in TX; where coverage is provided and administered by Consumer Program Administrators, Inc. dba The Administrators of Consumer Programs (TX License #175), in FL and OK; where coverage is provided and administered by Automotive Warranty Services of Florida, Inc. (Florida License #60023 and Oklahoma License #44198051), and in WA; where coverage is provided by National Product Care Company and administered by Consumer Program Administrators, Inc., all located at P.O. Box 802746 Chicago, Illinois 60680-2747, 866.502.1868. This coverage is made available to you by CUNA Mutual Insurance Agency, Inc.

The purchase of Mechanical Repair Coverage is optional. This document provides general information about Mechanical Repair Coverage and should not be solely relied upon when purchasing coverage. Be sure to read the Vehicle Service Contract or the Insurance Policy, which will explain the exact terms, conditions and exclusions. Coverage varies by state. Replacement parts may be new, used, non-OEM or remanufactured of like kind and quality.

Payment Shield Plus is optional and will not affect your application for credit or the terms of any credit agreement required to obtain a loan. Certain eligibility requirements, conditions, and exclusions may apply. Please contact your loan representative or refer to the contract for a full explanation of the terms. You will receive the contract before you are required to pay Payment Shield Plus You may cancel the protection at any time. If you cancel protection within 30 days you will receive a full refund of any fee paid.

DP, GAP, MRC-7215031.1-1024-0327

SchoolsFirst Insurance Services, LLC Privacy Policy