These three little numbers can mean getting the best interest rates on loans, credit cards, insurance, buying a car or house, or even landing a job. The higher your score, the lower rates you'll enjoy, and vice versa. But if you have questions about how your credit score is determined, or why you have more than one, you're not alone. Here are answers to some common questions.

What makes up my credit score?

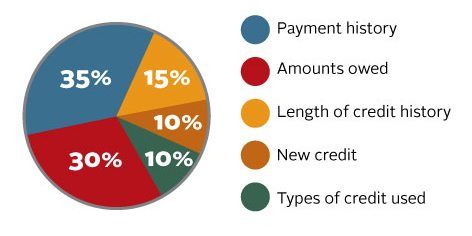

Your credit score, also known as a FICO score, is made up from the information taken from your credit reports. The information breaks down like this:

If you pay your bills on time, don't max out your credit lines, and don't apply too frequently for new credit, your credit score will be higher. Late payments are one of the biggest ways to quickly lower your score. Always pay your bills on time, even if you have to make a minimum payment.

Why do I have different scores?

There are three major credit reporting agencies: Equifax, Experian and TransUnion. Each uses their own scoring model to determine your score. Depending on the credit report they receive, and their own modeling system, your scores will differ. So even though your credit scores may vary slightly, keep in mind that how you handle your credit places you in a general credit range. If you fall in the good to excellent range, you're in good shape. If you fall below the top ranges you have some work to do.

Credit Ranges:

- Excellent Credit: 781-850

- Good Credit: 661-780

- Fair Credit: 601-660

- Poor Credit: 501-600

- Bad Credit: below 500

Are there more than three credit reporting agencies?

Yes, there are many reporting agencies out there that determine your credit risk. Historically, FICO was created by the Fair Isaac Corporation to create a standardized reporting system. But as the ability to track consumer behavior has become more precise, that's changed the way your credit behavior is analyzed. For instance, the SavvyMoney Credit score product uses VantageScore 3.0 to determine your credit score. The VantageScore uses a wider set of information combined with reviewing credit activity from the past 24 months to score your credit behavior. While VantageScore uses a different scoring range, the bottom line is: it's simply a benchmark for you to monitor your credit health.

How do I get my credit reports?

You're entitled to a free credit report annually at annualcreditreport.com. Keep in mind that while your credit reports are free, you will have to pay a fee to get your credit scores.

How do I keep my credit top-notch?

If you're just establishing credit, it may take a while to get a top score. Open up a credit card account, charge small amounts, and pay off your bill each month. This will build your credit history. If you have a credit history, but have taken on too much debt, rein in your spending and start paying it off as you can, starting with the card that has the highest interest rate. Monitor your credit, to track your progress